The 2024 Turbine Single-Engine Helicopter Market Trends

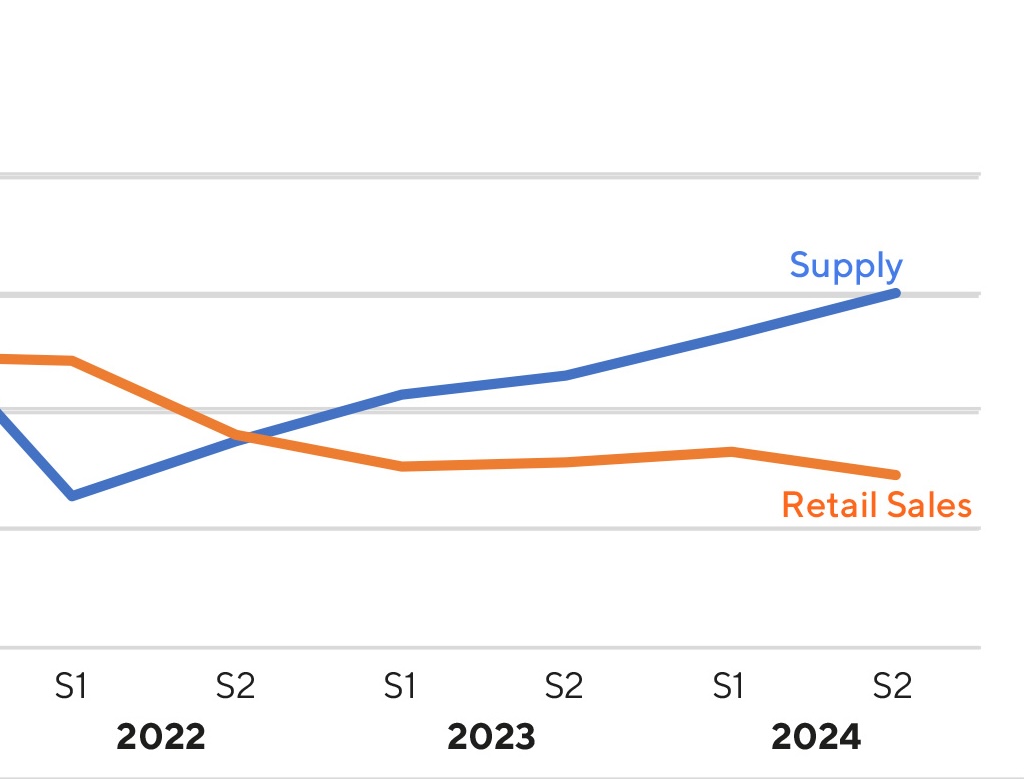

The preowned helicopter market continues to evolve, and the latest Heli Market Trends 2024 Annual Report from Aero Asset provides key insights into the performance of single-engine turbine helicopters. While retail sales remained stable last year, supply increased significantly, and transaction dynamics shifted. For operators and buyers, understanding these trends is critical for making informed decisions.

Analyzing the Market Shift

In 2024, the single-engine helicopter market saw notable changes. The average transaction price increased by 4% year-over-year, while average days on market climbed by 2%. This indicates a moderate cooling of demand despite stable sales numbers. The absorption rate, which measures how long it takes for helicopters to sell at current trade levels, also saw an increase, reaching an industry-wide average of 12 months.

North America and Asia-Pacific led the market in transaction volume, with North America accounting for two-thirds of all preowned single-engine helicopter sales in 2024. The Asia-Pacific region followed as the second most active market, with Europe ranking fourth.

Most and Least Liquid Models

Among single-engine turbine helicopters, the Airbus AS350B3/B3e/H125 series remained the most liquid, reinforcing its reputation as a preferred workhorse for commercial operations. Following closely behind was the Bell 407/GX/P/I series. These aircraft continue to attract buyers due to their versatility, performance, and availability of aftermarket support.

On the other end of the spectrum, the least liquid model in 2024 was the Airbus EC130B4/H130T2, with an absorption rate of approximately 1.5 years. This suggests that while these aircraft remain highly capable, they face longer sales cycles due to specific market conditions.

Rising Helicopter Supply | What It Means for Buyers and Sellers

Helicopter supply reached a four-year peak in the fourth quarter of 2024, with available aircraft for sale increasing 30% year-over-year.

Regionally, supply varied significantly:

Europe saw a 26% increase in available inventory, ending the year with 35% of the global stock.

Asia-Pacific had the largest year-over-year jump in supply, growing by 90% to comprise 25% of the global market.

North America accounted for 23% of available inventory, with a 36% increase in supply.

Latin America was the only region to experience a decline in supply, with inventory shrinking by 25%.

The rest of the world accounted for 7% of available aircraft, with a 22% increase.

For buyers, this increase in supply presents more opportunities to secure aircraft at competitive pricing. However, sellers may face increased pressure to adjust pricing or improve maintenance and refurbishment strategies to attract buyers in a more saturated market.

Key Takeaways for Operators and Investors

Market Stability with Gradual Price Increases: The 4% rise in average transaction prices reflects ongoing demand, but the increase in supply means buyers now have more negotiating power.

Regional Strengths: North America remains the strongest market for preowned single-engine helicopters, followed by Asia-Pacific.

Shifting Liquidity: While popular models like the AS350 and Bell 407 continue to sell well, less liquid aircraft like the EC130 may require more time on the market.

Strategic Buying and Selling: Operators looking to upgrade should carefully assess market conditions and aircraft availability to maximize value in transactions.

Looking Ahead | Preparing for 2025

As we move into 2025, operators and investors should keep a close eye on continued shifts in helicopter supply and demand. With higher inventory levels, competitive pricing, and extended sales cycles for some models, a well-informed approach to acquisitions and sales will be crucial.

For those looking to expand their fleet or optimize existing assets, staying ahead of these trends will ensure successful transactions in an evolving market. Whether buying or selling, engaging with industry experts and leveraging comprehensive market data will be key to making the right decisions in 2025 and beyond.